Best Cannabis Investments in the Medical Sector

Introduction

The medical cannabis sector has emerged as one of the most promising fields within the broader cannabis industry. As legalization continues to expand globally and research uncovers new therapeutic uses, investing in medical cannabis presents lucrative opportunities. This comprehensive guide explores the best cannabis investments in the medical sector, covering leading companies, emerging trends, and key factors to consider for maximizing returns.

1. Understanding the Medical Cannabis Market

Market Overview

The medical cannabis market is characterized by its rapid growth and evolving regulatory landscape. In 2024, the global medical cannabis market is projected to exceed $20 billion, driven by increased acceptance of cannabis as a treatment for various medical conditions, including chronic pain, epilepsy, multiple sclerosis, and anxiety.

Key Drivers of Growth

- Legalization and Regulatory Changes: Countries and states continue to relax cannabis laws, allowing for broader access to medical cannabis. This trend is expected to continue, opening new markets and driving demand.

- Aging Population: As the global population ages, the prevalence of chronic conditions treatable with cannabis increases, boosting market demand.

- Medical Advancements: Ongoing research and clinical trials are expanding the understanding of cannabis’s therapeutic potential, leading to new applications and higher adoption rates.

2. Leading Medical Cannabis Companies

Canopy Growth Corporation

Overview: Canopy Growth, headquartered in Canada, is one of the largest and most recognized cannabis companies globally. It operates in multiple countries and has a diverse product portfolio, including medical cannabis.

Investment Highlights:

- Strong Brand Recognition: Canopy Growth’s brand presence is a significant asset, ensuring customer loyalty and market penetration.

- Research and Development (R&D): The company invests heavily in R&D, driving innovation and developing new medical cannabis products.

- Strategic Partnerships: Collaborations with major pharmaceutical companies enhance Canopy’s product offerings and market reach.

GW Pharmaceuticals (a subsidiary of Jazz Pharmaceuticals)

Overview: GW Pharmaceuticals is renowned for its pioneering work in cannabinoid-based medicines. It developed Epidiolex, the first FDA-approved CBD-based drug for treating epilepsy.

Investment Highlights:

- FDA Approval: The approval of Epidiolex sets a precedent for other cannabis-based medications, bolstering investor confidence.

- Robust Pipeline: GW Pharmaceuticals has a strong pipeline of cannabinoid-based drugs targeting various conditions, promising future growth.

- Global Reach: The company’s products are available in numerous countries, providing a broad market base.

Tilray, Inc.

Overview: Tilray is a global leader in the cannabis sector, focusing on medical cannabis products. The business has operations in Europe, North America, and other continents.

Investment Highlights:

- Diversified Portfolio: Tilray offers a wide range of medical cannabis products, catering to various patient needs.

- Strategic Acquisitions: The company has acquired several smaller firms, enhancing its capabilities and market presence.

- Strong International Presence: Tilray’s international activities help to reduce the risks brought on by changes in regulations in a particular country.

3. Emerging Trends in Medical Cannabis Investment

Biotech and Pharmaceutical Integration

The integration of cannabis with biotechnology and pharmaceutical industries is a significant trend. Companies are leveraging biotech advancements to develop more effective and targeted cannabis-based treatments.

Investment Opportunities:

- Novel Drug Development: Investing in companies focused on cannabinoid-based drug development can yield high returns as new therapies gain regulatory approval.

- Personalized Medicine: Companies working on personalized cannabis treatments, tailored to individual genetic profiles, represent a cutting-edge investment opportunity.

International Expansion

As more countries legalize medical cannabis, companies are expanding their operations internationally. This trend provides investors with opportunities to tap into new and growing markets.

Investment Opportunities:

- Market Entry: Investing in companies entering newly legalized markets can provide substantial returns as these markets mature.

- Export Potential: Companies with the capability to export medical cannabis products to multiple countries stand to benefit from global demand.

Technological Advancements

Technological innovations are transforming the medical cannabis industry. From advanced cultivation techniques to digital health platforms, technology is enhancing efficiency and product quality.

Investment Opportunities:

- AgTech Solutions: Companies developing advanced cultivation technologies, such as precision agriculture and vertical farming, can significantly reduce production costs and improve yields.

- Digital Health Platforms: Investing in digital health companies that integrate medical cannabis into telemedicine and patient management systems can capitalize on the growing trend of digital healthcare.

4. Key Factors to Consider for Investing in Medical Cannabis

Regulatory Environment

Understanding the regulatory landscape is crucial for medical cannabis investments. Regulations vary widely across countries and even within regions, affecting market access and compliance costs.

Considerations:

- Legal Status: Ensure the legal status of medical cannabis in the target market and monitor potential changes in legislation.

- Compliance: Invest in companies with robust compliance frameworks to mitigate risks associated with regulatory violations.

Market Demand

Assessing market demand for medical cannabis products helps identify the most promising investment opportunities.

Considerations:

- Prevalence of Treatable Conditions: Focus on markets with high prevalence of conditions treatable with cannabis, such as chronic pain and epilepsy.

- Patient Adoption: Analyze patient adoption rates and preferences to identify products with high market potential.

Financial Health

Evaluating the financial health of potential investments is essential for minimizing risks and ensuring sustainable returns.

Considerations:

- Revenue Growth: Look for companies with strong and consistent revenue growth, indicating market acceptance and operational efficiency.

- Profitability: Assess profitability metrics, such as EBITDA and net income, to gauge financial stability.

- Cash Flow: Ensure the company has positive cash flow or a clear path to achieving it, as this indicates financial resilience.

Competitive Landscape

Understanding the competitive landscape helps identify companies with a sustainable competitive advantage.

Considerations:

- Market Share: Companies with significant market share are often more resilient to competitive pressures and market fluctuations.

- Product Differentiation: Look for unique product offerings or proprietary technologies that provide a competitive edge.

- Strategic Partnerships: Collaborations with pharmaceutical companies, research institutions, or technology firms can enhance a company’s market position.

5. Case Studies of Successful Medical Cannabis Investments

Case Study 1: Canopy Growth and Constellation Brands

In 2018, Constellation Brands, a leading beverage company, invested $4 billion in Canopy Growth. This investment provided Canopy with significant capital to expand its operations and product offerings.

Investment Outcome:

- Expansion: The investment enabled Canopy to acquire several companies and expand its international footprint.

- Innovation: The funding supported R&D initiatives, resulting in new product launches and technological advancements.

- Market Leadership: Canopy solidified its position as a market leader, with a diverse product portfolio and strong brand recognition.

Case Study 2: GW Pharmaceuticals and Epidiolex

GW Pharmaceuticals’ development of Epidiolex, the first FDA-approved CBD-based drug, is a landmark achievement in the medical cannabis sector.

Investment Outcome:

- Regulatory Approval: The FDA approval of Epidiolex validated the therapeutic potential of cannabis, attracting significant investor interest.

- Revenue Growth: Epidiolex generated substantial revenue, contributing to GW Pharmaceuticals’ strong financial performance.

- Acquisition: In 2021, Jazz Pharmaceuticals acquired GW Pharmaceuticals for $7.2 billion, reflecting the high value of cannabinoid-based drug development.

6. Risks and Challenges in Medical Cannabis Investments

Regulatory Risks

The medical cannabis sector is subject to complex and evolving regulations, posing significant risks.

Mitigation Strategies:

- Stay Informed: Regularly monitor regulatory changes and engage with legal experts to ensure compliance.

- Diversify: Invest in companies operating in multiple jurisdictions to mitigate risks associated with regulatory changes in any single market.

Market Volatility

The cannabis industry is known for its market volatility, influenced by regulatory developments, market sentiment, and other factors.

Mitigation Strategies:

- Long-Term Perspective: To weather market turbulence, prioritize long-term investments above quick rewards.

- Diversified Portfolio: Diversify investments across different companies and segments within the medical cannabis sector.

Operational Challenges

Medical cannabis companies face operational challenges, including production scalability, quality control, and supply chain management.

Mitigation Strategies:

- Due Diligence: Conduct thorough due diligence to assess a company’s operational capabilities and identify potential risks.

- Invest in Leaders: Focus on established companies with proven track records of operational excellence and scalability.

7. Future Outlook and Investment Opportunities

Personalized Medicine

Personalized medicine, which tailors treatments to individual patients based on genetic profiles, is a promising frontier in medical cannabis.

Investment Opportunities:

- Genetic Testing Companies: Invest in companies offering genetic testing services to develop personalized cannabis treatments.

- Precision Medicine Platforms: Companies integrating cannabis with precision medicine platforms present high-growth potential.

Expansion into New Markets

The continued expansion of medical cannabis into new markets presents significant opportunities for investors.

Investment Opportunities:

- Emerging Markets: Focus on companies entering newly legalized markets with high growth potential.

- Export-Oriented Companies: Companies with established export channels can capitalize on global demand for medical cannabis.

Technological Integration

Technological advancements, including artificial intelligence (AI), blockchain, and advanced cultivation techniques, are transforming the medical cannabis industry.

Investment Opportunities:

- AI and Data Analytics: Companies using AI and data analytics to optimize cultivation and develop new treatments are poised for growth.

- Blockchain: Investing in blockchain technology for supply chain transparency and quality control can enhance operational efficiency and product credibility.

Top 5 Medical Cannabis Strains to Invest In

Investing in specific cannabis strains can be a strategic move within the medical cannabis sector. The right strains, known for their therapeutic benefits, can drive significant market demand and generate substantial returns. Here are the top five medical cannabis strains to consider for investment:

1. Charlotte’s Web

Overview: Charlotte’s Web is perhaps the most famous medical cannabis strain, named after Charlotte Figi, a young girl whose severe epilepsy was effectively treated with this strain. It is a high-CBD, low-THC strain known for its powerful therapeutic effects without causing a high.

Therapeutic Benefits:

- Epilepsy and Seizure Disorders: Proven to reduce the frequency and severity of seizures in patients with epilepsy.

- Anxiety and Depression: Its calming effects help in managing anxiety and depression.

- Pain Management: Effective in reducing chronic pain and inflammation.

Investment Potential:

- High Demand: As one of the most well-known medical strains, it has a strong market presence and demand.

- Regulatory Approval: Increasing acceptance and regulatory approvals for medical use in various regions.

- Brand Strength: Associated with trust and efficacy in the medical community.

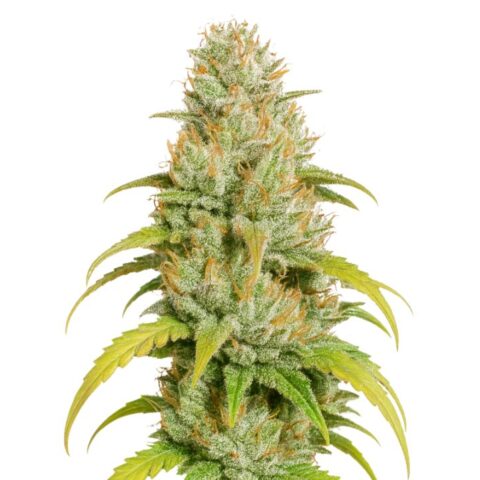

2. ACDC

-

CBD ACDC Cannabis SeedsFrom: $24.99

CBD ACDC Cannabis SeedsFrom: $24.99

Overview: ACDC is a high-CBD strain with a CBD to THC ratio of about 20:1, making it ideal for medical use without psychoactive effects. Because of its remarkable capacity to significantly relieve a variety of medical ailments, it is especially well-liked.

Therapeutic Benefits:

- Chronic Pain: Provides effective pain relief without the high associated with THC.

- Multiple Sclerosis: Helps in managing symptoms like muscle spasms and pain.

- Anxiety and PTSD: Its calming effects make it suitable for treating anxiety and PTSD.

Investment Potential:

- Versatile Applications: Its wide range of medical applications ensures consistent demand.

- Patient Preference: Favored by patients seeking relief without psychoactive effects.

- Research and Development: Ongoing studies may expand its recognized medical uses, further boosting demand.

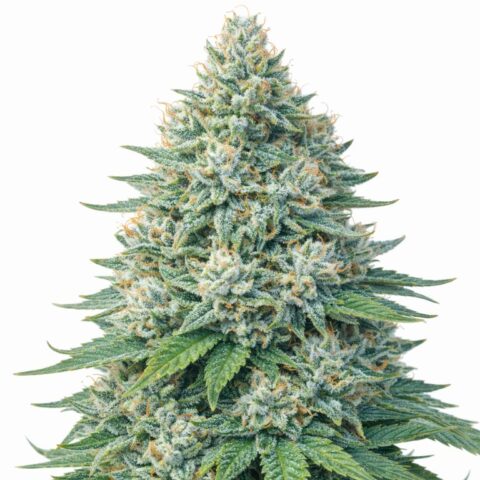

3. Harlequin

-

Harlequin CBD Cannabis SeedsFrom: $24.99

Harlequin CBD Cannabis SeedsFrom: $24.99

Overview: Harlequin is a sativa-dominant strain with a high CBD content, typically featuring a 5:2 CBD to THC ratio. It is known for providing clear-headed relief from pain and anxiety.

Therapeutic Benefits:

- Pain Relief: Effective in managing chronic pain without heavy sedation.

- Anxiety and Stress: Reduces anxiety and stress, promoting mental clarity.

- Inflammation: Anti-inflammatory properties help in conditions like arthritis.

Investment Potential:

- Balanced Effects: Its balanced cannabinoid profile makes it versatile for various medical conditions.

- Patient Satisfaction: High levels of patient satisfaction and demand due to its effective relief without strong psychoactive effects.

- Growing Market: As awareness and acceptance of CBD increase, so does the market for strains like Harlequin.

4. Cannatonic

-

Cannatonic Cannabis SeedsFrom: $24.99

Cannatonic Cannabis SeedsFrom: $24.99

Overview: Cannatonic is a hybrid strain renowned for its high CBD content and therapeutic benefits. It typically has a 1:1 CBD to THC ratio, providing mild psychoactive effects alongside significant medical benefits.

Therapeutic Benefits:

- Pain and Muscle Spasms: Highly effective in treating chronic pain and muscle spasms.

- Migraine Relief: Used to alleviate the symptoms of migraines and headaches.

- Mood Disorders: Helps in managing mood disorders like depression and anxiety.

Investment Potential:

- Broad Spectrum of Uses: Suitable for a variety of medical conditions, ensuring wide market appeal.

- Market Growth: As medical cannabis becomes more accepted, demand for versatile strains like Cannatonic is expected to rise.

- Product Development: Potential for development into various product forms, including oils, tinctures, and edibles.

5. Blue Dream

-

Blue Dream Cannabis SeedsFrom: $24.99

Blue Dream Cannabis SeedsFrom: $24.99

Overview: Blue Dream is a hybrid strain with balanced effects and a reputation for its versatility in treating a range of medical conditions. It combines the best traits of its parent strains, Blueberry and Haze.

Therapeutic Benefits:

- Chronic Pain: Effective in managing chronic pain and neuropathic pain.

- Depression and Anxiety: Uplifting effects help in treating depression and anxiety.

- Nausea and Appetite Loss: Useful for patients undergoing treatments like chemotherapy.

Investment Potential:

- High Popularity: One of the most popular and widely recognized strains in the medical cannabis market.

- Wide Availability: Its popularity ensures widespread cultivation and availability, enhancing market penetration.

- Product Versatility: Can be developed into various forms, catering to different patient preferences and needs.

Detailed Conclusion

The medical cannabis sector stands at the intersection of rapid market expansion, evolving regulatory landscapes, and groundbreaking medical research. This unique convergence presents substantial opportunities for investors seeking to capitalize on the therapeutic potential of cannabis. A comprehensive understanding of the sector’s dynamics, key players, emerging trends, and specific strains can guide investors towards informed and strategic decisions.

Market Dynamics and Growth Drivers

The global medical cannabis market, projected to surpass $20 billion by 2024, is primarily driven by several critical factors:

- Legalization and Regulatory Evolution: Progressive legalization across various regions continues to dismantle legal barriers, fostering a conducive environment for market growth. Countries and states are increasingly recognizing the medicinal value of cannabis, paving the way for broader access and increased patient adoption.

- Demographic Shifts: An aging global population correlates with a higher incidence of chronic conditions such as arthritis, neuropathic pain, and neurodegenerative diseases, all of which are treatable with medical cannabis. This demographic trend significantly bolsters market demand.

- Medical Advancements: Continuous research and clinical trials are expanding the understanding of cannabis’s therapeutic benefits. New cannabis-based therapies for a variety of ailments are being developed, which raises the industry’s profile and acceptance rates.

Leading Companies in Medical Cannabis

Investing in established companies within the medical cannabis sector can offer stability and growth potential. Key players include:

- Canopy Growth Corporation: As a market leader with a diverse product portfolio and strong international presence, Canopy Growth is a compelling investment. The company’s commitment to research and development, strategic partnerships, and brand recognition position it favorably for sustained growth.

- GW Pharmaceuticals: Known for its pioneering cannabinoid-based medications like Epidiolex, GW Pharmaceuticals represents innovation in the sector. The company’s robust drug pipeline and FDA approvals underscore its potential for long-term success.

- Tilray, Inc.: With a broad product range and strategic acquisitions, Tilray’s diversified approach and global operations make it a strong contender in the medical cannabis market.

Emerging Investment Trends

Emerging trends in the medical cannabis sector highlight new avenues for investment:

- Biotech and Pharmaceutical Integration: The convergence of cannabis with biotech and pharmaceuticals is driving the development of more effective and targeted treatments. Investments in companies focusing on cannabinoid-based drug development and personalized medicine can yield high returns.

- International Expansion: The global legalization trend is opening new markets for medical cannabis. Companies with the foresight to enter these emerging markets and establish export capabilities are poised to benefit significantly.

- Technological Advancements: Innovations in cultivation techniques, digital health platforms, and blockchain for supply chain transparency are transforming the industry. Companies leveraging these technologies to enhance efficiency and product quality present promising investment opportunities.

Specific Strains with High Investment Potential

Investing in specific medical cannabis strains known for their therapeutic benefits can be highly profitable. The top strains to consider include:

- Charlotte’s Web: Renowned for its effectiveness in treating epilepsy and other conditions, this high-CBD strain has a strong market presence and patient trust.

- ACDC: This strain’s high CBD content and broad therapeutic applications make it a favorite among patients seeking relief without psychoactive effects.

- Harlequin: Harlequin has a balanced ratio of THC to CBD, which provides a range of medical advantages and great patient satisfaction.

- Cannatonic: Known for its efficacy in treating pain and muscle spasms, Cannatonic’s balanced cannabinoid profile ensures wide market appeal.

- Blue Dream: As one of the most popular strains, Blue Dream’s broad therapeutic applications and market recognition make it a solid investment choice.

Risk Management and Strategic Considerations

While the medical cannabis sector offers lucrative opportunities, it also entails certain risks:

- Regulatory Risks: The sector’s regulatory environment is complex and subject to change. Investors must stay informed about legal developments and ensure compliance to mitigate risks.

- Market Volatility: The cannabis industry is characterized by significant market volatility. Adopting a long-term investment perspective and diversifying investments can help manage this volatility.

- Operational Challenges: Issues related to production scalability, quality control, and supply chain management can impact profitability. Conducting thorough due diligence and focusing on companies with proven operational excellence is crucial.

Final Thoughts

The medical cannabis sector presents a compelling investment landscape, driven by regulatory advancements, demographic trends, and continuous medical research. By strategically investing in leading companies, capitalizing on emerging trends, and selecting high-demand strains, investors can position themselves to benefit from the sector’s growth.

Understanding the regulatory environment, market demand, financial health, and competitive landscape of potential investments is essential for making informed decisions. Despite the inherent risks, the potential rewards in the medical cannabis sector are substantial, offering investors the chance to contribute to improved patient outcomes while achieving significant financial returns. The secret to optimizing investment success in this expanding market will be to remain knowledgeable and flexible as the business changes.